Gross salary calculator hourly rate

The second algorithm of this hourly wage calculator uses the following equations. Weekly paycheck to hourly rate.

How To Calculate Gross Pay Youtube

On a 60k salary or a 40k salary.

. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. Semi-Monthly Salary Annual Salary 24. A yearly salary of 60000 is 3077 per hourThis number is based on 375 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Federal income tax rates range from 10 up to a top marginal rate of 37. Federal Income-- --State Income-- --.

Just enter your annual pre-tax salary. Companies can back a salary into an hourly wage. It assumes 40 hours worked per week and 20 unpaid days off per year for vacation and holidays.

Then multiply the product by the number of weeks in a year 52. What is my hourly rate if my annual salary is. 120 per day 8 hours 15 per hour.

Salary Calculator Gross to NETNet to Gross Standard 2022. A project manager is getting an hourly rate of 25. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12.

HoursWeek HoursDay Work DaysYear HoursYear. Net annual salary Weeks of work per year Net weekly income. Switch to salary calculator.

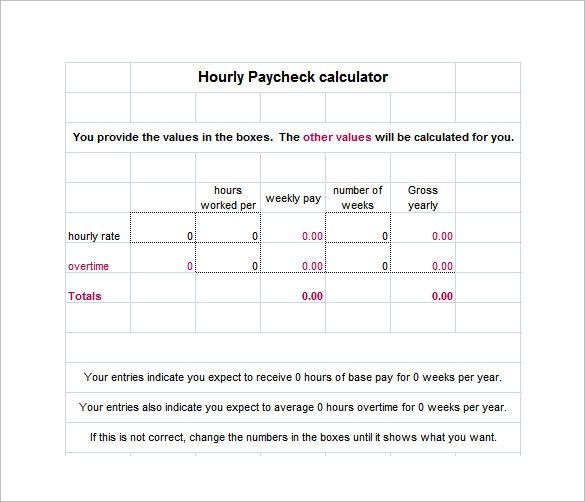

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Net annual salary Weeks of work per year Net weekly income.

What are the tax rates on gross salary. Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885. Update health insurance tax deduction latest income tax in 2022.

Annual Salary Hourly Wage Hours per workweek 52 weeks. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. To calculate annual salary to hourly wage we use this.

To calculate annual salary to hourly wage we use. Weekly Salary Daily Salary Days per workweek. Free tool to converter gross to net salary net to gross salary.

Switch to Washington hourly calculator. Net weekly income Hours of work per week Net hourly wage. The formula of calculating annual salary and hourly wage is as follow.

For example if youre a salaried employee with a 20000 annual salary but you received an incentive bonus of 2000 your gross salary is 22000. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour. Biweekly Salary Annual Salary 26.

Quarterly Salary Annual Salary 4. To enter your time card times for a payroll related calculation use this time card calculator. Browse different tax rate table tax brackets and the Here are the.

Your 45000 salary explained. Net weekly income Hours of work per week Net hourly wage. If you make 45 000 a year how much is your salary per hour.

Enter your regular annual salary numerals only to calculate your bi-weekly gross. Average hourly rate. Gross Paycheck --Taxes-- --Details.

If you get paid bi-weekly once every two weeks your gross paycheck will be 2308. Calculating Hourly Rate Using Annual Salary. UK salary calculator with comprehensive explanations of your tax NI and take-home pay based on your yearly and monthly gross income.

All other pay frequency inputs are. Enter your info to see your take home pay. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington paycheck calculator.

The Personal income tax PIT as well as tax rates and deductibles are currently regulated by Decree No. Enter Your Regular Annual Salary. If you get paid bi-weekly once every two weeks your gross paycheck will be 1 731.

Gross Pay or Salary. 1500 per week 40 hours per week 3750 per hour. Regular Hours per Year Regular Hours per Day X 261 Work Days per Year.

By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. UK Salary Calculator. A yearly salary of 45 000 is 2163 per hourThis number is based on 40 hours of work per week and assuming its a full-time job 8 hours per day with vacation time paid.

You can quickly calculate your net salary or take-home pay using the calculator above. This tool will estimate both your take-home pay and income taxes paid per year month and day. For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by multiplying the hourly rate by 40.

Gross annual income - Taxes - CPP - EI Net annual salary. If you make 60000 a year how much is your salary per hour. Daily wage to hourly rate.

Monthly Salary Annual Salary 12. Wondering what hourly rate you earn on a 50k annual salary in Ontario. To calculate your hourly rate from your annual salary please refer to the chart below.

Your gross hourly rate will be 2163 if youre working 40 hoursweek. Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52. Whereas gross salary is the amount you pay.

3 Ways To Calculate Your Hourly Rate Wikihow

4 Ways To Calculate Annual Salary Wikihow

Annual Income Calculator

Avanti Gross Salary Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Hourly To Salary Calculator

Hourly Paycheck Calculator Step By Step With Examples

Salary To Hourly Calculator

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Calculating Income Hourly Wage Youtube

Hourly To Annual Salary Calculator How Much Do I Make A Year

Gross Income Formula Step By Step Calculations

Hourly To Salary What Is My Annual Income

Gross Pay And Net Pay What S The Difference Paycheckcity

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

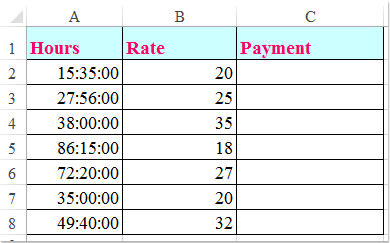

How To Multiply Hours And Minutes By An Hourly Rate In Excel

Salary Calculator